Strategy

What is an event-driven credit strategy?

This strategy aims to identify and capitalize on credit issuers that are undergoing significant changes, such as mergers and acquisitions, spinoffs and restructurings. The strategy is flexible and can take both long and short positions to take advantage of these situations and keep hedges in place to help mitigate downside volatility.

Why invest in our event-driven

credit strategy?

- Diversification. Adding a unique event-driven credit strategy, which is generally uncorrelated and has zero-to-low beta to traditional assets, can be a source of alpha and may improve the overall diversification of a portfolio.

- Performance enhancement. The strategy is designed to target equity-like returns with lower volatility through a full market cycle, offering attractive risk reward potential.

- Consistent income. Total return potential through income and capital gains.

How does our event-driven

credit strategy work?

The investment process begins once an event is identified:

EVENT

Identify and respond to corporate news such as press releases,

filings and news headlines.

INVESTMENT THESIS

Analyze financial statements and bond covenants for a view on

the potential impact to bonds.

IDENTIFIED CATALYST

Isolate the key thesis drivers with a specific date and conviction

on upside/ downside.

OUTCOME

Add on thesis affirmation and disciplined sell process on investment conclusion.

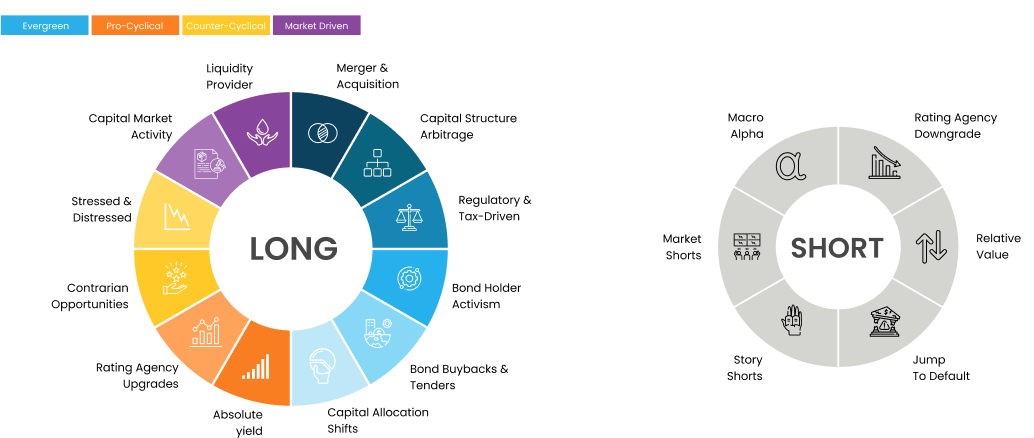

Event-driven opportunities can be found and categorized into sub-strategies both on the long and short side. Dynamic allocation to these sub-strategies based on market conditions and opportunities help navigate through market cycles.

There is no guarantee that a hedging strategy will be effective or achieve its intended effect. The use of derivatives or shorts selling carries several risk which may restrict a strategy in realizing its profit or limiting its losses. which may cause the strategy to realize a loss. There may be additional costs and expenses associated with the use of derivatives and short selling in a hedging strategy.

Rate Risk

bond price decreases

when interest rates rise

Other Risks

e.g: liquidity, currency risks

Credit Risk

Distressed issuers,

probability of default

There is no guarantee that a hedging strategy will be effective or achieve its intended effect. The use of derivatives or short selling carriers several risks which may restrict a strategy in realizing its profits or limiting its losses, which may cause the strategy to realize a loss. There may be additional costs and expenses associated with the use of derivatives and short selling in a hedging strategy.

Who is our event-driven credit strategy for?

Our long short event-driven credit strategy may be suitable for investors who:

- Desire diversification using a strategy with low correlation to other investments.

- Seek a strategy that targets a return higher than traditional bond strategies, while generating steady income.

- Want access to hedging tools that aim to mitigate risks commonly associated with income investing, including interest rate risk, liquidity risk, currency risk, and credit risk.

What event-driven credit investment products does Picton Mahoney offer?

Alternative Investment Solutions are available as mutual funds, liquid alternative funds and hedge funds. Our suite of Fortified Mutual Funds, Fortified Alternative Funds and Authentic Hedge® Funds give investors more choice and ease of access to alternative strategies, adding an alternative source of returns to fortify a portfolio. Our goal, for over 18 years, through different market cycles and investing environments, has been to improve the quality of returns by offering alternative investment solutions.

Related Fund Profiles

This information has been provided as a general source of information, is subject to change without notification and should not be construed as investment advice. This material should not be relied upon for any investment decision and is not a recommendation, solicitation or offering of any security in any jurisdiction. The information contained in this material has been obtained from sources believed reliable, however, the accuracy and/or completeness of the information is not guaranteed by Picton Mahoney Asset Management (PMAM), nor does PMAM assume any responsibility or liability whatsoever. All investments involve risk and may lose value. This information is not intended to provide financial, investment, tax, legal or accounting advice specific to any person, and should not be relied upon in that regard. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

There is no guarantee that a hedging strategy will be effective or achieve its intended effect. The use of derivatives or short selling carries several risks which may restrict a strategy in realizing its profits, limiting its losses, or, which cause a strategy to realize or magnify losses. There may be additional costs and expenses associated with the use of derivatives and short selling in a hedging strategy.

The offering of units of the Picton Mahoney Authentic Hedge® funds are made pursuant to an Offering Memorandum only to those investors in jurisdictions of Canada who meet certain eligibility or minimum purchase requirements. Prospective investors should consult with their investment advisor to determine suitability of investment. Please see the Fund’s Confidential Offering Memorandum for more information, including investment objectives and strategies, risk factors and investor eligibility.

Commissions, trailing commissions, management fees, performance fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Alternative mutual funds can only be purchased through a registered dealer and are available only in those jurisdictions where they may be lawfully offered for sale.